M&A ADVISORY

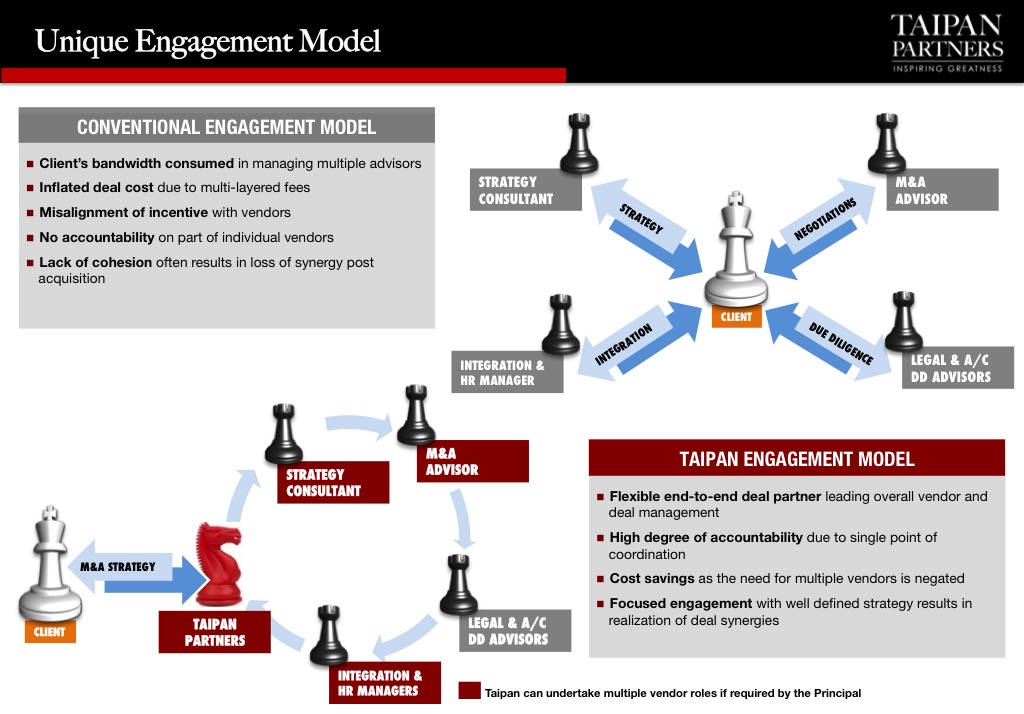

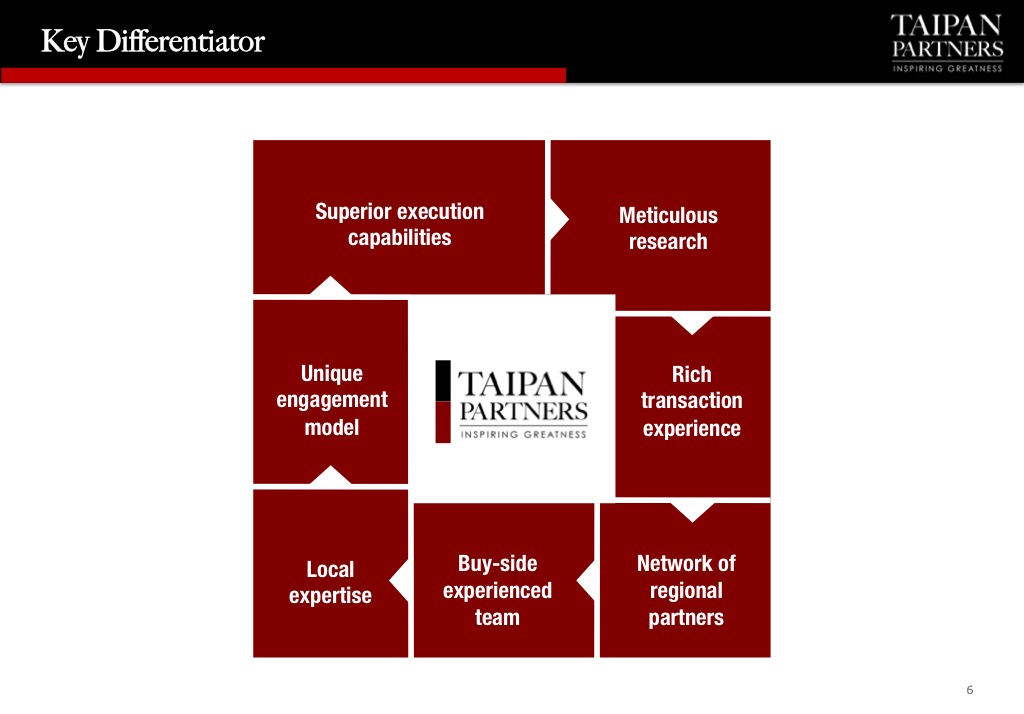

We offer bespoke M&A advisory services, specializing in end-to-end transaction management and value creation. Our proprietary Taipan Engagement Model bridges gaps found in traditional advisory, providing our clients with unparalleled leverage across mergers, acquisitions, and capital structuring. With expertise rooted in private equity and corporate finance, our team manages the entire deal lifecycle to deliver seamless, high-value results.

To download our M&A Advisory brochure.

Focus Area

Strategic transactions

Buy/Sell side advisory

Leveraged buy-outs

Corporate restructurings

Sectors Served

Consumer, Logistics, Financial Services, Media, and Technology

Geography

Asia, with a focus on ASEAN and South Asia.

RESEARCH

Our research team excels in identifying emerging sectors and market trends, guiding clients in capital allocation and market entry strategies. Through in-depth due diligence and macroeconomic analysis, we enable asset managers, corporations, and government entities to capitalize on untapped opportunities.

Focus Area

Strategic due diligence

Sector research (top-down and bottom-up)

Country-specific economic strategy

Trend analysis and investment drivers

Our commitment to rigorous analysis and strategic insight has earned us the trust of a diverse client base, including asset managers, conglomerates, and public institutions.

INTEGRATION

Streamlining M&A HR Integration for Seamless Transitions

At Taipan Partners, we specialize in aligning people strategies with business objectives to ensure smooth M&A transitions and drive long-term value creation. Our expertise spans every aspect of workforce integration, including organizational design, cultural alignment, talent retention, and communication planning.

We combine strategic insight with hands-on execution to address complexities like leadership alignment, workforce optimization, and change management. By prioritizing the human capital aspect of your transaction, we enable faster realization of business synergies and sustainable growth.

Unlock the full potential of your business with our M&A Advisory services

Contact us today to discuss strategies tailored to your goals.